If your home doubles as your solopreneur or self-employed headquarters, then you may qualify for the home office tax deduction this tax season. Whether you’re self-employed , own a small business, or work from home in any capacity, this deduction can help you cover the costs of maintaining a home office.

Our guide explains who qualifies and which calculation methods to use—plus, we share five potential home tax deductions for this tax season.

The home office tax deduction offers two distinct qualifiers: regular and exclusive use and principal place of business.

The type of work you do and the business you run can affect which one you’ll use for the at-home office tax deduction. Let’s explore which method is best for you.

The regular and exclusive use qualifier requires that you use a specific area within your home exclusively for business purposes and dedicate it to work-related activities regularly.

For your home business to qualify, this means:

Example: A freelance graphic designer designates a spare room exclusively for work, ensuring it's solely used for graphic design projects and client meetings.

The Principal place of business qualifier focuses on whether the home is the primary location for substantial administrative or managerial activities related to your business.

To qualify for the working from home office tax deduction, this means:

Example: An online consulting firm owner conducts administrative and managerial tasks, such as client communications and strategic planning, from their dedicated home office, making it the principal place of business.

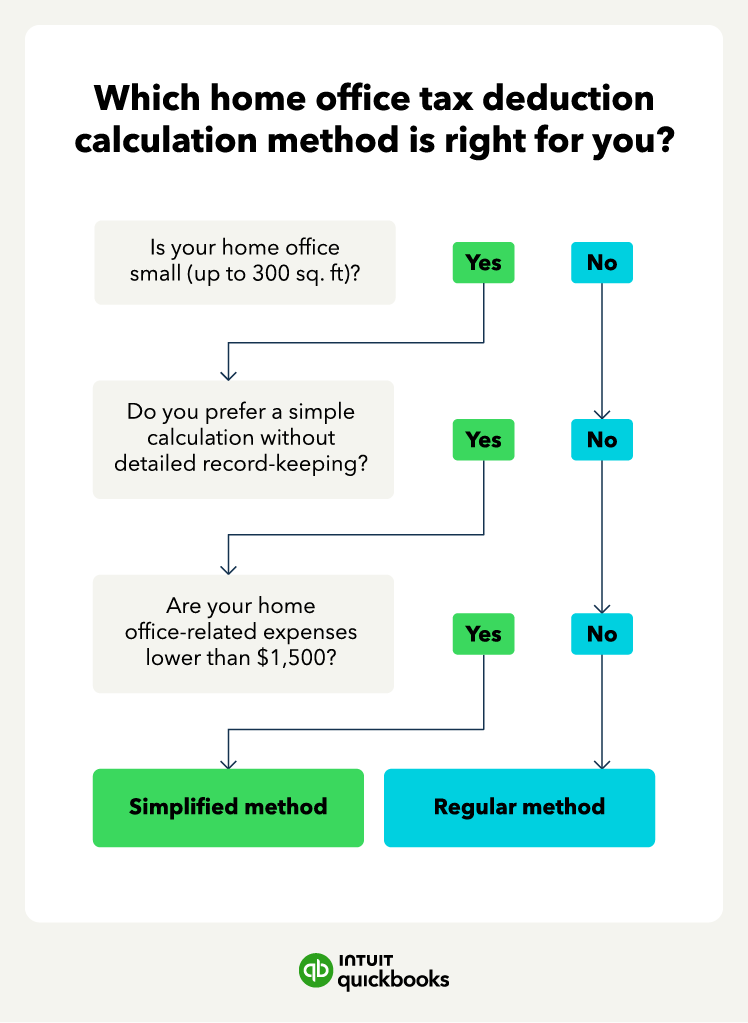

When calculating your work-from-home office tax deduction, you have two options to choose from—the simplified method or the regular method. Here’s a quick overview of how both calculations work according to the IRS :

Now that you’re familiar with the basics, let’s explore both calculation methods to help you decide which one is best for your business this tax year.

The simplified method for determining the home office deduction is straightforward and arguably easier and more popular. Here’s how it works:

When you use the simplified method, you can’t take a depreciation deduction on your home, but you also don’t have to worry about calculating depreciation when you sell your home for a profit.

With the regular method, you manually calculate the percentage of your home that you use for business. You can simplify your home office use calculation to determine how much of the following can be deducted for business use as well:

Depending on your situation, the regular method can result in a larger tax deduction. But it also requires more attentive recordkeeping and calculations.

Use Form 8829 to see a comprehensive list of business expenses that can potentially qualify for the IRS home office tax deduction.

After you select which method will work best for your business, here's a step-by-step breakdown of how to calculate your deduction.

To calculate how much of a home office tax deduction you qualify for using the simplified method:

Keep in mind that you cannot write off more than 300 square feet of home office space in the 2023 tax year using this method. Here’s an example of how this method works in a real scenario.

Example: Let’s say your office is 200 square feet. With the $5 per square foot rule, the resulting deduction would be $1,000.

Here's how to determine your deduction using the regular method:

Example: If your home is 2,500 square feet and your home office is 400 square feet, you use 16% of your home for business. You can add up to 16% of your housing payments, mortgage interest, utility costs, and insurance premiums to use as your home office deduction. Plus, you can deduct the entire cost of a direct expense like deep cleaning your home office.

If your deduction amount is larger than your gross income from the business use of your home, it’s possible to carry the excess amount to the next year. So if your deduction comes to $3,500, but your gross income from using your home amounts to $3,000, you can’t claim that “extra” $500, but you can carry it over to the next year. This is a feature that isn’t possible with the simplified method.

You can use either method—regular or simplified—in any taxable year, no matter which method you used in a prior year.

Whatever deduction you’re looking for, run the numbers to see which method would benefit you most. If the paperwork becomes too burdensome, expense-tracking software like QuickBooks Self-Employed can help you perform the calculations and make the right decision.

From workspace expenses to technology investments, uncover the deductions that can contribute to a more financially advantageous filing this tax season. Here are five IRS tax write-offs that your home office could potentially qualify for.

Example: utility payments

If you use 25 percent of your home’s entire square footage as an office, you may claim 25 percent of your mortgage interest or rent payments, insurance premiums, and property taxes in tax-deductible expenses. You may deduct the same percentage of your utility payments, which may include telephone services, electricity, gas, and cleaning services.we

Example: desk and chair

Beyond your computer and other work-related equipment, you may claim a tax deduction for your desk, chair, coffee table, and even the expensive art on your wall. Make sure that any decorative item you deduct stays in your office to avoid potential audit woes.

Example: office renovation

Did you paint your office or redo its floors? Repairs and improvements to your workspace are tax-deductible, though some larger expenses (such as new carpet) may be subject to an asset-depreciation schedule.

Example: an exclusive business phone

Although you may not take a tax deduction for maintaining a primary phone line, you may claim a separate business line. If you use a single line for business and personal calls, you can itemize the business calls and claim those as a deduction.

Example: roof repairs

The average homeowner or renter incurs home-related expenses beyond rent or mortgage, which may include snow plowing, roof repair, and trash removal. These types of expenses are also deductible, according to the square footage percentage of your home used as a business.

A word of caution: It’s easy to get overzealous in claiming home-office tax deductions, and improperly classifying expenses is an easy way to trigger an audit. When filling out your tax returns, carefully review the IRS documents related to home-office tax deductions, and talk to an accountant about what you should and shouldn’t claim based on your circumstances.

Out of all of the small business tax deductions , qualifying for the home office tax deduction can potentially result in the largest amount of savings this tax year.

With two calculation methods to choose from and online accounting tools at your disposal, managing tax deductions for your home office can be made more manageable. As always, consult a tax professional to understand your options.

Consider choosing the simplified method for a small home office. The regular method may be best for potentially higher deductions, especially within a larger space.

What if your business has just one home office, but you do most of your work elsewhere?If your business has just one home office, but you conduct most of your work elsewhere, you may still qualify for a home office tax deduction if you exclusively and regularly used the home office for business purposes.

If I'm self-employed, should I take the home office tax deduction?Yes, you can qualify for this freelancer-friendly self-employed home office tax deduction. You will still need to choose which calculation method you’ll use and adhere to the home office tax deduction requirements.

If I'm an employee working from home, do I qualify for a home office tax deduction?If you are self-employed, you can qualify for this deduction. If you work for an employer, you do not qualify for the home office tax deduction.

Recommended for you

17 common self-employed tax deductions for lowering your tax bill

February 23, 2024

Schedule A Deductions: Personal Deductions With Business Implications

February 17, 2016

LLCs for Freelancers? Here’s Why It Makes Sense

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.